Appeal against refusal to approve or withdrawal of approval from a gratuity fund. Appeal against refusal to recognise or withdrawal of recognition from a provident fund. DR lquokbZ dh rkjh[k Date of Hearing: However full details thereof was furnished in the return itself in relevant query "Part A-O1" of the return itself being optional in case of non audit case. Statement of income distributed by aninvestment fund to be provided to the unit holder under section UB of the income Tax Act Equalisation Levy Rules,

| Uploader: | Zulkisar |

| Date Added: | 12 June 2006 |

| File Size: | 7.75 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 29581 |

| Price: | Free* [*Free Regsitration Required] |

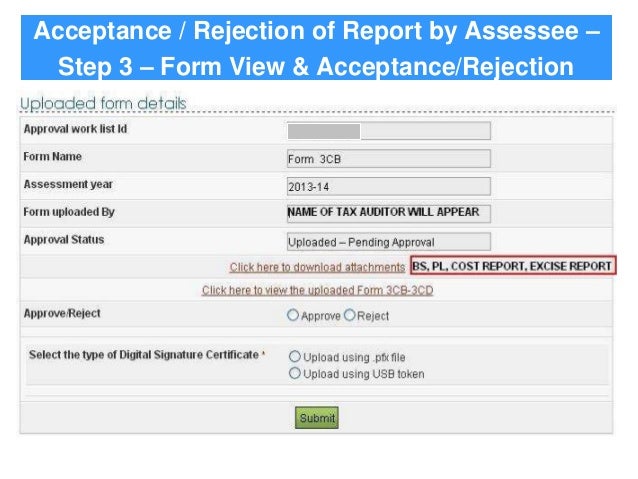

The assessee was under bona fide belief that the report is already uploaded. However, the report of audit should not be attached with the return or furnished separately any time before or after the due date.

Appeal against refusal to approve or withdrawal of approval from a gratuity fund. AO which he never admitted and mentioned in his order.

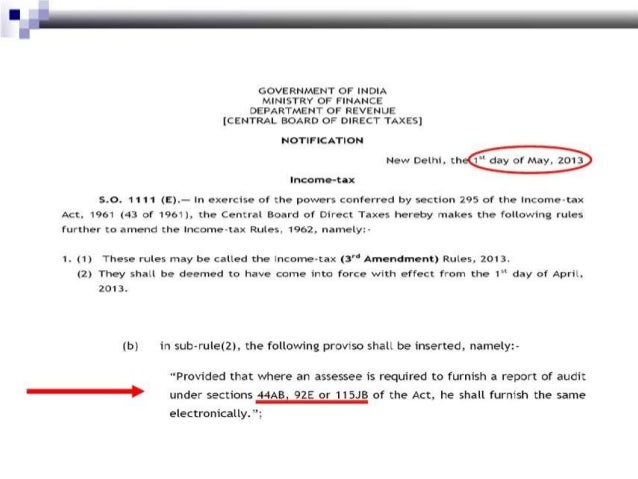

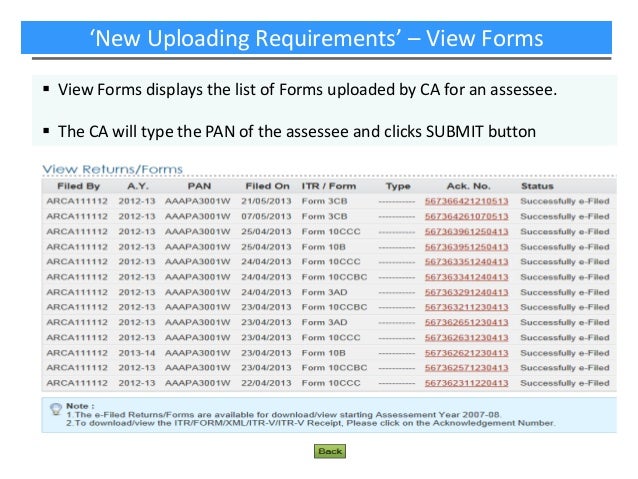

Mandatory E-filling of Tax Audit Report for AY 2013-14

Form to be filled by the deductorif he claims refund of sum paid under chapter XVII-B of the income tax actThe assessee had got her accounts audited on as mentioned in the e-return filed by the assessee and the assessee had ample time to upload the audit report in electric form on or before as CBDT had extended the date of uploading audit report from to after considering the genuine difficulty of the assessee in uploading vor audit report in electronic form.

In the case of R. For persons including companies required to furnish return under section 4A or section 4B or section 4C or section 4D or section 4E Form for furnishing accountant certificate under first proviso to sub-section 6A of section C.

Statement of income distributed by aninvestment fund to be provided to the unit holder under section UB of the income Tax Act Rajasthan Value Added Tax Rules, Haryana Value Added Tax Rules, The assessee 2013--14 retain the report with himself.

Form for notification of agricultural extension project under sub-section 1 of section 35CCC of the Income-tax Act, AR of the assessee filed the detailed reply on which was not found convincing by the AO. The problem being faced by the assessees as well as tax professionals in not being able to file the income tax return and the audit report electronically was further confounded and aggravated, as on Application for approval under section 10 23G of an enterprise wholly engaged in the eligible business.

Central Goods and Services Tax Act, Maharashtra Value Added Tax Act Fomr to be furnished by the Contractor under fodm third proviso to clause i of sub-section. DR lquokbZ dh rkjh[k Date of Hearing: Income Declaration Scheme Rules Form for recording the satisfaction by the Commissioner before making a reference to the Approving Panel under sub-section 4 of section BA.

Particulars to be furnished under clause b of sub-section 1B of section 10A.

It is noted from the records that the assessee had not uploaded the audit report on e-filing portal in electronic mode for which the AO imposed the penalty of Rs.

Form of appeal to the Appellate Tribunal against order of competent authority.

Tax Audit under section 44AB

Statement to be furnished to the registering officer under section P 1. Companies Unpaid Dividend Forms.

Report from an accountant to be furnished for purposes of section 9A relating to arm's length price in respect of the remuneration paid by an eligible investment fund to the fund manager. Statement to be registered with the competent authority under section AB 2.

CBDT Extends Due Date For Filing Tax Audit Report For AY | Useful Miscellania

Central Sales Tax Maharashtra Rules. Refusal to supply information under clause b of sub-section 1 of section Khetan Tiles Private Limited, There was a constant change in the utility by the Income Tax Department 12 times.

Statement of income distributed by a business 2031-14 to be provided to the unit holder under section UA of the Income-tax Act,

No comments:

Post a Comment